The leaders in the field of microfinance are of the view that a time has come for all microfinance institutions to digitize microfinance services to provide easy access to the deprived and marginalized community. They urged that the use of digital technology can bring a lot of returns, more achievements with less time, less cost, and less effort. This is the conclusion of the speakers of the webinar on Digitalization in Microfinance: Opportunities and Challenges organized by the Center for Self-help Development under the 10th Webinar Talk Series held on 4th July, 2021.

Addressing the webinar, Mr. Shankar Man Shrestha, Chairman of the Center for Self-help Development (CSD), said that the microfinance sector could not stay away from the digital world in the current scenario. However, he opined that the use of digital technology should also be pro-poor and the use of technology should not harm the essence and purpose of microfinance. "We are in the age of technology. Technology has revolutionized in every walk of life. Now it is also a time for microfinance to change and make its services better. However, we must be cautious. It should be used in right manner. Along with technology MFIs should ensure quality of microfinance and taking services to the doorstep of the poorest. It should not be the end but tool to raise efficiency and quality of operation.”

Mr. Shrestha also mentioned that microfinance is a system that is intertwined with human relations, and it is essential to focus on how digitalization maintains the foundations and strengths of physically interconnected relationship between member and staff.

In their presentations, the speakers argued that digital microfinance services are indispensable in the present context of changing needs and expectations of people. There are both opportunities and challenges. It is also important to be aware of the risks posed by digitalization.

Speaking on the occasion, Mr. Dambar Bahadur Shah, General Manager of the Kisan Multipurpose Cooperative Ltd, said that the use of digital technology in microfinance services has made it easier for the employees to work and for the members to get services in prompt manner. Earlier, Mr. Shah informed that the Kisan Multipurpose Cooperative Limited has used digital facilities and technologies such as tablet banking, mobile miscall service, QR code service, e-service, and about 57,000 microfinance members have received daily payment services and all banking facilities. He also informed that the use of digital technology has made it possible for the business of each branch to be available within 7 seconds and also helped smooth operation of administrative work and manpower management in the organization.

Another speaker at the Webinar, Mr. Govinda Bahadur Raut, Assistant Chief Executive Officer of Muktinath Development Bank, said that the use of digital technology has made the service faster, more effective, less expensive, and more transparent. He also mentioned that digital services would be effective also in curbing fraud and illegularities in financial transactions at various levels of microfinance operations. He said that it has eased understanding the status of each activity and conduct loan analysis of microfinance members. Mr. Raut also informed that more than half of the 140,000 microfinance members of Muktinath Development Bank are using mobile banking services as well.

In his presentation, Mr. Sanjay Kumar Mandal, Chief Executive Officer of Jeevan BikasLaghubitta Bittiya Sanstha Ltd. Morang said ?The use of digital technology is essential for the smooth and effective delivery of microfinance services to the target group. At present, Jeevan Bikas has provided services to its members through its app including cash transactions, bill payment services, and important information, and 72,000 members have benefited from this service”. He further added? The Jeevan Bikas has also created a digital member in each of the villages where digital transaction service is not available to the member. The Digital member conducts transactions on their behalf and Rs. 1 billion has been transacted online so far. This way we have also been providing through online service such as as e-sewa, khalti, knowledge of the entire area of work through GPS technology and about 1,000 centers have been able to conduct cashless transactions.”

He added digitization has also eased manpower management and mobilization, staff record keeping and other information collection and updating. He said that where there is no internet service and members do not have smart phone and no idea to operate mobile, the digital members provided services in center meeting operations.

The speakers said that there is a great challenge to educate members and take them into confidence in the use of digital technology. They opined that the digital technology needs to be microfinance member-friendly, and MFIs should provide financial literacy, as well as technical literacy to the staff and members.

Mr. Satish Shrestha, the moderator of the webinar and director of CSD, said that the use of digital technology by microfinance institutions should not only be seen as an opportunity to cater services during the corona epidemic and lockdown but also be seen as a mechanism to improve the flow of microfinance services and increase the efficiency and productivity of work.

The webinar was attended by 157 officials and staffs from banks and the financial sectors.

Under the initiation of the principle Microfinance Institutions (MFIs) and co-ordination of the Centre for Self-help development (CSD) a first ever, national level 'National Microfinance more...

“Entrepreneurship Development, the Way towards Poverty Alleviation”

For the first time in the history of microfinance in Nepal, and unheard of in the global more...

In view of the stir created by the new Monetary Policy of the Nepal Rastra Bank (NRB) among the Microfinance Institutions (MFIs), the Centre for Self-help Development (CSD) felt the need more...

On Shrawan 28, 2073 (August 12, 2016) promoters, individuals and institution members, former Board Directors, Microfinance Institution leaders and friends came together at the Hotel Yellow more...

The Centre organized a two-day seminar for the Board Officials of the prominent microfinance cooperatives of Nepal on the request of various Cooperative Institutional Members of the Centre more...

‘Learning gives creativity, Creativity leads to thinking, Thinking provides knowledge, Knowledge makes you great’ – APJ Abdul Kalam

Kick starting the year 2017, the Centre for more...

On the morning of February 9, 2017 the Centre for Self-help Development (CSD) in joint collaboration with the Grameen Trust (GT), Bangladesh initiated a two-day program on the Grameen more...

A nine member team comprising Board of Directors from 2 FINGOs from Nepal, namely- Dhaulagiri Community Development Centre (DCRDC, Baglung) and Sreejana Community Development Centre (SCDC, more...

It is with deep sorrow and regret we bid farewell to Mr. Nanda Ram Baidya who passed away on August 15, 2017. In memory of the affable and ever encouraging figure the Centre for Self-help more...

On the morning of March 9, 2017 the Centre for Self-help Development organized an interaction program on an experience sharing session with Mr. Chandra Shekhar Ghosh, Founder and Managing more...

The Centre for Self- help Development (CSD) organized a training program titled "Advanced Training of Trainers" held in Kathmandu. The five day training program was held from September more...

Over the years, the Microfinance Institutions (MFIs) in Nepal have been proactive in providing financial as well as social services to vitalize the financially excluded households in more...

The pioneer microfinance institution of Nepal, the Centre for Self-help Development (CSD) convened its 26th Annual General Meeting on October 8, 2017 amidst its members, both individual more...

- An experience of Nepalese Delegation

A delegation of Nepalese microfinance officials visited the Philippines from January 15-19, 2018 on the invitation of the Microfinance Council of more...

CSD has appointed Mr. Bechan Giri as the new Executive Chief effective from December 26, 2017. Mr. Giri’s appointment comes with the resignation of former Executive Chief of CSD, Mr. more...

To enable microfinance institutions to apply sound accounting principles to ensure high quality of financial analysis the Centre for Self-help Development conducted a three-day training more...

- A Symposium of Board Officials

In over 25 years of service to the financially excluded segments of the society, the microfinance sector has thrived and expanded its outreach to the more...

Keeping in view the strong and rapid growth pattern in the microfinance sector and the competitive lending environment, CSD organized a three day training program titled "Training on Risk more...

“Learn as if you were to live forever” – Mahatma Gandhi

Realizing the immense potential to learn from each other through experience sharing and field visits within the country itself, more...

When the fundamentals of microfinance are followed, great outcomes are achieved. This is true with Bandhan Bank which has been given universal banking license by the Central Bank of India more...

Bangladesh is often hailed as the ‘Mecca of Microfinance’ across the world. The concept of micro-credit and the credit worthiness of the poor was first discussed by Prof. Muhummad Yunus in more...

(1).jpg)

One of the pioneering institutions to provide microfinance services in Nepal the first licensed NGO, the Centre for Self-help Development (CSD) celebrated its 27th Anniversary at a more...

The Centre for Self-help Development (CSD) one of the pioneers of microfinance in Nepal convened its 27th Annual General Meeting on October 26, 2018 in Kathmandu. The meeting was attended more...

A training to develop “Managerial Skills” of Branch Managers of MFIs was organized by CSD in Kathmandu from January 7-9, 2019 (Poush 23-25, 2075) to enhance managerial skill level of the more...

A one-day dialogue on microfinance was organized by Unique Nepal Laghubitta Bittiya Sanstha Ltd. on February 9, 2019 (Magh 26, 2075) in Hotel Atithi, Kohalpur. A total of 42 participants, more...

On the invitation of the Grameen Trust, Bangladesh a delegation of nine senior Nepalese microfinance practitioners led by Mr. Shankar Man Shrestha, Chairman of CSD visited Bangladesh from more...

The team observed that all the members are borrowers and strictly followed the basic fundamental of microfinance like conducting weekly meeting, implementing credit plus activities, more...

The microfinance sector in Nepal has been mushrooming at an alarming rate in the past five years. Newer microfinance institutions (MFIs) have sprung up, who do not necessarily follow the more...

“If we can turn unemployment into entrepreneurship, the amount of human creativity, talent and productivity we will unleash is almost beyond measuring” – Prof. Muhammad Yunus

Taking more...

The Centre for Self-help development (CSD) organized a conference on Human Resource Management for microfinance Institutions from Ashadh 10-11, 2076 in Dhulikhel, Kavre. The conference was more...

From June 28 – 29, 2019 over 1,500 delegates from across the world came together to celebrate and take forward social business on a global scale at the 9th Social Business Day (SBD) held more...

Microfinance has existed as one of the major contributors to poverty alleviation serving over 4 million members in the seventy seven districts of Nepal. But in recent times the sector has more...

One of the initiators of microfinance services and the first licensed microfinance NGO in Nepal, the Centre for Self-help Development (CSD) celebrated its 28th Anniversary at a function more...

.jpg)

The Centre for Self-help Development (CSD), which is one of the pioneer institutions to launch microfinance in Nepal, convened its 28th Annual General Meeting on December 13, 2019. The more...

The Centre for Self-help Development (CSD), which is one of the pioneer institutions to launch microfinance in Nepal, organized a Symposium on Fraud Control and Management on December 14, more...

CSD Chairman Mr. Shankar Man Shrestha felicitated on January 21, 2020 by the Agricultural Development Bank on the occasion of its 53rd Anniversary for his valuable contribution to the more...

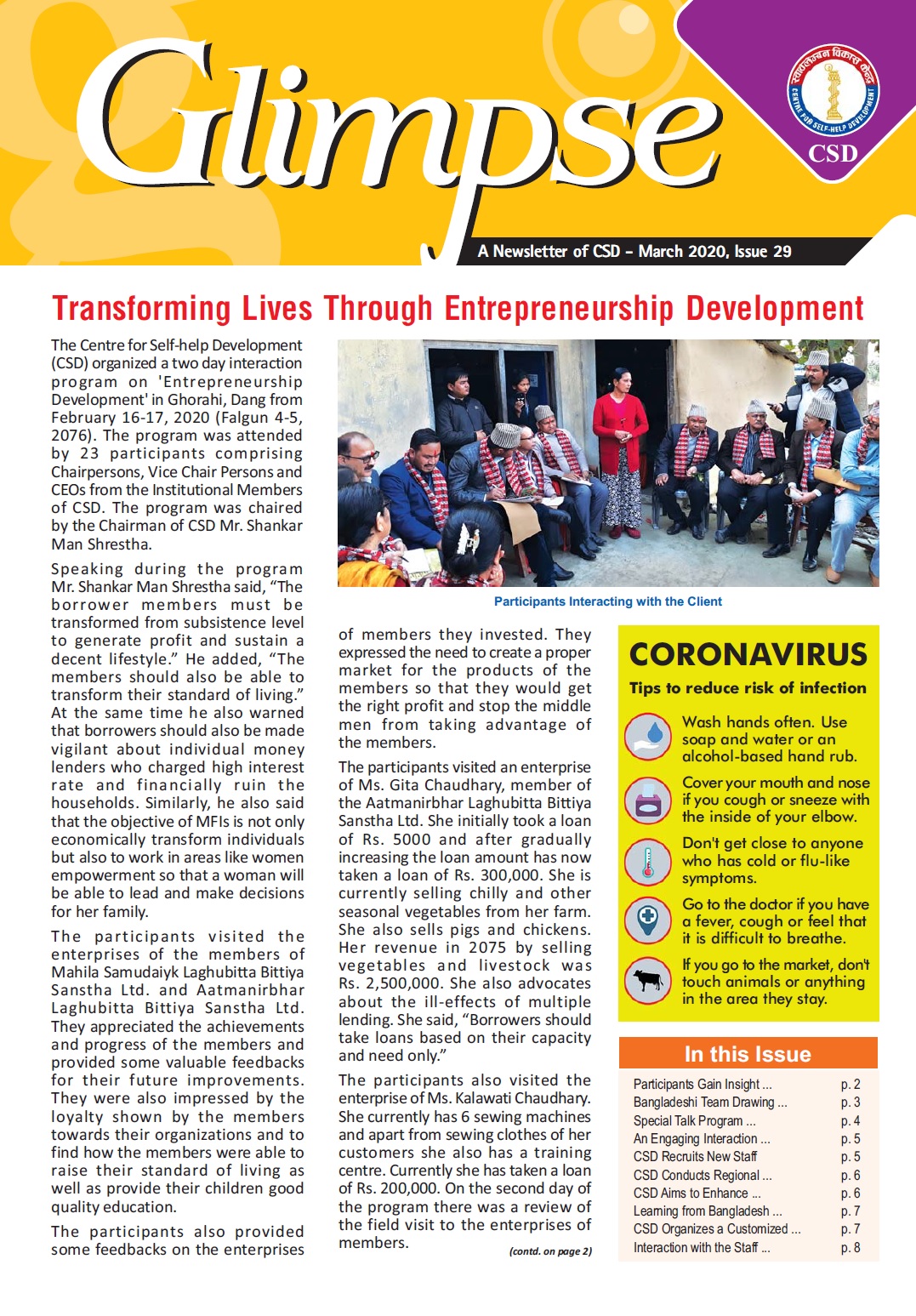

With the rapid expansion of microfinance sector in past few years in Nepal, the sector has been facing numerous problems and challenges due to deviations from the true essence and more...

The Centre for Self-help Development (CSD) has entered in 30th year. It was established on August 13, 1991 (Shrawan 28, 2048) with the vision of alleviating poverty by raising the living more...

The Chairman of the Center for Self-help Development (CSD), Mr. Shankar Man Shrestha in a webinar organized by CSD on Bhadra 2, 2077 (August 18, 2020) urged the officials of Kisan more...

A webinar was organized by the Centre for Self-help Development on March 2, 2021 to acquaint development practitioners with basic concept of eco-village model, its approach and possible more...

CSD has expanded its team members to better coordinate and cope with the new activities as well strengthen the standard of its service delivery. It is very fortunate to have additional 5 more...

The extent of the damage that the novel coronavirus pandemic is causing is mind-boggling. However, the situation also offers us an unparalleled opportunity.We have experience in managing more...

The Sree Ram Higher Secondary School, Koshidekha, Panchkhal Municipality ward no 13, Kavrepalanchok district launched a student entrepreneurship development program in cooperation with the more...

The Centre for Self-help Development (CSD) has entered in 30th year. It was established on August 13, 1991 (Shrawan 28, 2048) with the vision of alleviating poverty by raising the living more...

CSD organized a virtual interaction with its member cooperative organizations on August2, 2020 to discuss on problems and challenges and opportunities arisen from the corona virus pandemic more...

Chairman of the Centre for Self-help Development Mr. Shankar Man Shrestha has suggested the microfinance staff to face the Corona epidemic and lockdown crisis while maintaining the essence more...

The Chairman of the Center for Self-help Development (CSD), Mr. Shankar Man Shrestha in a webinar organized by CSD on Bhadra2, 2077 (August 18, 2020) urged the officials of Kisan more...

The Center for Self- help Development (CSD) organized a 3 day PPI Training of Trainers (TOT) to 23 senior officials and branch managers of microfinance institutions in Biratnagar in more...

The Centre for Self-help Development (CSD) organized a study/exposure visit to Bangladesh from March 19-26, 2023. The visit team consisted of nine Board Members and one staff member of more...

The Chairman of the Centre for Self-help Development (CSD) Mr. Shankar Man Shrestha has suggested the microfinance practitioners to study and review the problems and opportunities faced more...

The Centre for Self-help Development (CSD) has instituted Micro-Entrepreneurship Award for three outstanding micro-entrepreneurs from among the women members MFIs. The award carries Rs. more...

Centre for Self-help Development (CSD) organized two day of Virtual training on "Promotion and Development of Micro-entrepreneurship among microfinance Members" on November 24-25, 2020 more...

During the lockdown period, the Centre for Self-help Development (CSD) conducted online interactions with CEOs and Department Heads of its member organizations. A total of six online more...

The Centre for Self-help Development (CSD) convened its 29th Annual General Meeting (AGM) on November 27, 2020 (Marg 12, 2077). The AGM was attended by 9 individual and 38 institutional more...

CSD Chairman Mr. Shankar Man Shrestha felicitated on January 20, 2020 by SLBBL on the occasion of its 19th Anniversary for his valuable contribution to the creation and development of the more...

CSD organized two day virtual training on "Identification and Development of Micro-Entrepreneur Members" from Magh18-19,2077, (Jan31-Feb1, 2021) where17 branch managers and senior field more...

The Centre for Self-help Development (CSD) has provided a desktop computer with necessary accessories to Kunchipwakal Secondary School under the Tarkeshwor Municipality-1, Kathmandu in its more...

The Centre for Self- help Development (CSD) organized a virtual webinar on “Sharing Grameen Bank Experience on Managing Impact of COVID 19 Pandemic and Post COVID Programs” on 20th January more...

The Centre for Self-help Development (CSD) awarded three best Microfinance Entrepreneurs members with the title of “Best Micro-entrepreneur Award-2076.” Honorable Minister for Land more...

The Chairman of the Centre for Self-help Development (CSD) Mr. Shankar Man Shrestha handed over a cheque of Rs. 2 lakh to the Samata Education Trust on March 9, 2021 as a token of support more...

On March 05, 2021 (Falgun 21, 2077) the Centre for Self-help Development (CSD) successfully completed a review webinar on the action plan developed by participating branch managers of more...

The Center for Self-help Development (CSD) conducted a two–day training on “Leadership Development and Stress Management” in microfinance on March 18-19, 2021 (Chaitra 05-06, 2077). The more...

With the main objective of knowing the knowledge and skill gained during the training "Gear up yourself" which was held on January 18-19, 2021(Magh 5-6, 2077) is practically applicable to more...

The Centre for Self-help Development (CSD) conducted a two-day virtual training on "Identification and Development of Micro–entrepreneur Members in Microfinance on March 14-15, more...

CSD on Chaitra 02, 2077 (March 15, 2021) hosted yet another webinar as part of Experience Sharing forum for microfinance institutions officials. This webinar talk program was participated more...

A webinar was organized by the Centre for Self-help Development (CSD) on March 30, 2021 to apprise microfinance practitioners and other stakeholders on problems and effects caused by more...

The Centre for Self-help Development (CSD) organized a webinar talk on April 16, 2021 to sensitize microfinance practitioners and other stakeholders on policy level as well as practical more...

A webinar talk on Vitality and Vulnerability of Wholesale Lending Organizations in the Present Niche Market of Microfinance was organized by the Centre for Self-help Development (CSD) on more...

A webinar on Neutralizing Corona Impact on Microfinance was organized by the Centre for Self-help Development (CSD) on May 13, 2021. The second wave of COVID-19 in Nepal is more lethal and more...

A webinar talk program on “Happy Leaders Can Change the World” was organized by the Centre for Self-help Development (CSD) on May 31, 2021 with the aim to to discuss on the concept of more...

A webinar talk (Series No 9) on Secrets of Success in Microfinance was organized by the Centre for Self-help Development (CSD) on June 16, 2021. The webinar focused on philosophy and more...

The leaders in the field of microfinance are of the view that a time has come for all microfinance institutions to digitize microfinance services to provide easy access to the deprived and more...

Microfinance has completed a three-decade long journey in Nepal. With continuous campaigns, it had brought awareness among the poor women in rural Nepal. Microfinance practitioners have more...

Four institutional members of the Centre for Self-help Development (CSD) have been accredited by the international “Smart Campaign, Client Protection Certification.” The awardees are the more...

The Training of Trainers (ToT) aiming to spread covid-19 education among the community was organized jointly by the Centre for Self-help Development (CSD) and RMDC Laghubitta Bittiya more...

Expressing concern over the growing discrepancies and deviations in microfinance, experts have warned microfinance practitioners and stakeholders to be vigilant in time. In the webinar more...

The Centre for Self-help Development (CSD) established in 1991 with the objectives of creating poverty free self-help society through awareness rising and of the masses and mobilization of more...

The Centre for Self-help Development (CSD) has organized two days long training on Participatory Rural Appraisal (PRA) on August 20-21, 2021 for the 16 high officials of the Centre for more...

The Centre for Self-help Development (CSD) had initiated a new approach to the follow-up of the training conducted by it with a view to ensure that the skills learned by the training are more...

A webinar talk series (Episode 14) on “Microfinance Policies, Practices and Problems in Sri Lanka” was organized by the Centre for Self-help Development (CSD) on September 6, 2021, with more...

The Centre for Self-help Development (CSD) held a six-month progress review of its second training on "Identification and Development of Micro-entrepreneurs" on September 12, 2021, which more...

A virtual Master Training of Trainers (ToT) to educate communities on COVID-19 via ZOOM was jointly organized by the Centre for Self-help Development (CSD) and RMDC Laghubitta Bittiya more...

Experts have argued that the lack of good governance in Microfinance Institutions (MFIs) has led to deviations from its main mission of serving the lower strata of the population and more...

Microfinance institutions have a strong belief that their grass-root level financial inclusion program has bestowed the fight against global challenges such as poverty, unemployment, and more...

A tripartite agreement on "Self-help Eco-village Development" was signed between the Centre for Self-help Development (CSD), the Mahila Sahayogi Bachat Tatha Rin Sahakari Sanstha Ltd. more...

The Centre for Self-help Development (CSD) convened its 30th Annual General Meeting (AGM) on December 2, 2021 (Marg 16, 2078). The AGM was attended by 6 individual and 26 institutional more...

On 13th of December 2021, the Centre for Self-help Development (CSD) put forward its 17th episode of webinar entitling "Human Resource Development and Management in Microfinance more...

CSD organized a two day "Mindful Leadership Development" Program for the Chairperson, CEOs and DCEOs of Microfinance Institutions and Cooperatives operating microfinance program from more...

The Centre for Self-help Development (CSD) organized a webinar talk on “Experience of Grameen Koota on Poverty Reduction and Employment Creation in India” to acquaint microfinance and more...

The Centre for Self-help Development (CSD) has organized a two-day leadership development training to increase women participation in management decision level of the Microfinance with more...

Kathmandu. Three women entrepreneur members who became successful entrepreneurs by taking loans from different microfinance institutions have been awarded the Best Micro-Entrepreneur more...

A webinar talk (episode no. 19) on “Entrepreneurship Development among Students-An Experience of Janajyoti Higher Secondary School, A Rural School of Surkhet District” was organized by the more...

The Sree Ram Higher Secondary School, Koshidekha, Panchkhal Municipality ward no 13, Kavrepalanchok district launched a student entrepreneurship development program in cooperation with the more...

The Centre for Self-help Development (CSD) convened 12th Social Business Day 2022, Country Forum of Nepal on June 29, 2022 based on the theme, “Building a New Civilization-Before the more...

The Centre for Self-help Development (CSD) which is the pioneer NGO in microfinance sector celebrated its 31st anniversary on 13th August, 2022 (Shrawan 28, 2079). During the occasion, more...

The Centre for Self-help Development (CSD) organized three Exposure Visits of microfinance practitioners of different Microfinance Institutions (MFIs) and Microfinance Cooperative more...

CSD organized a week long exposure/study visit of Nepali MFIs to Socialist Republic of Vietnam from August 13 to 20, 2022 to learn the microfinance policies, programs, approaches and more...

The Centre for Self-help Development (CSD) in partnership with the University of New South Wales (UNSW), Sydney, Australia, organized a seminar on the topic "Emerging Challenges and more...

Branch managers and employees of microfinance institutions were encouraged to mobilize more resources in their hands for reliability of financial resources supporting for lending the more...

A review program was conducted on February 27, 2023 with the participation of the heads of MFIs to discuss the latest status and progress on the implementation of 11-point declaration of more...

A five-day specially tailored program on entrepreneurship development was organized by Centre for Self-help Development (CSD) for the Branch Managers of Swabalamban Laghubitta Bittiya more...

Convoked 31st General Assembly of CSD: Emphasized on Promotion of Social Entrepreneurship and Expansion of Microfinance Reach to Hard-Core Poor

The 31st General Assembly of the Centre more...

The 31st General Assembly of CSD has elected a seven-member Board of Directors for the next two years. In this committee, the elected members are: the founding members of CSD, Mr Shankar more...

The Center for Self- help Development (CSD) organized a 3 day PPI Training of Trainers (TOT) to 23 senior officials and branch managers of microfinance institutions in Biratnagar in more...

Experts are of the view that the 8-point directive of the Nepal Rastra Bank (NRB) will help to improve the quality as well as the strength of the microfinance sector in long term and bring more...

The Centre for Self-help Development organized an online orientation program on “Progress out of Poverty (PPI) Index” on November 8, 2022. The objective of the program was to orient more...

In the last two decades microfinance in Nepal has taken a big leap forward in terms of the number of institutions providing loans, volume of loan transactions and the number of client more...

The First Provincial Microfinance Members' Summit of the Koshi Province was concluded with the vow to make microfinance services civilized, dignified and effective and also decided to more...

The Centre for Self-help Development (CSD) organized a 4 day field based Self-help Eco-village Development workshop from January 29 to February 1, 2023 at Dhulikhel Lodge Resort, more...

The Centre for Self-help Development (CSD) has initiated an entrepreneurship development program with the aim of developing about 5,000 entrepreneur women among microfinance members within more...

The Centre for Self-help Development (CSD) organized a study/exposure visit to Bangladesh from March 19-26, 2023. The visit team consisted of nine Board Members and one staff member of more...

On the occasion of 32nd Anniversary of the Centre for Self-help Development held on August 13, 2023, MFIs and microfinance practitioners who have made outstanding contribution in providing more...

Shankar Man Shrestha Microfinance Award is provided to any individual or institution that adheres to the norms, principles and values of microfinance and acts as a role model in carrying more...

The Centre for Self-help Development (CSD) awarded Micro-entrepreneurship Development Award and Best Entrepreneurs award for the year 2023 2023 on the occasion of its 32nd Anniversary more...

In a proactive effort to fortify the microfinance sector, the Centre for Self-help Development (CSD) orchestrated a successful three-day training program titled "Internal Audit & Control" more...

The first ever conference with the aim to completely eliminate three burning issues prevalent in today’s world which are poverty, employment and net carbon emission by brining youths in more...

On the occasion of 4th Nation Microfinance Member Summit 38 MFIs members, staffs, centre chief, 3 Zero Club were recognized & appreciated. Where 11 Centre Chief, 1 organization, 10 Staff, more...

The 32nd Annual General Meeting of the Centre for Self-help Development (CSD) was held on Sunday, December 10, 2023. The meeting decided to urge MFIs and MFCs to work to improve the more...

The Centre for Self-help Development (CSD) which is the pioneer NGO in microfinance sector in Nepal celebrated its 32nd anniversary on 13th August, 2023 (Shrawan 28, 2080).

With the theme “Prudent Microfinance, Prosperous Members”, the 4th National Microfinance Members' Summit, Nepal concluded with the issuance of a comprehensive 12-point declaration, more...

The Centre for Self-help Development (CSD) have awarded three best entrepreneur members and one best entrepreneurship development organization for their outstanding performance on the more...

A conference with the aim to completely eliminate three burning issues prevalent in today’s world which are poverty, employment and net carbon emission by brining youths in decision making more...

On the occasion of 4th Nation Microfinance Member Summit 38 MFIs members, staffs, centre chief, 3 Zero Club were recognized & appreciated. Where 11 Centre Chief, 1 organization, 10 Staff, more...

The Centre for Self-help Development (CSD) organized a 4-day Training on Entrepreneurship Development including one day field study visit of successful client entrepreneur from May 7th to more...

A total of 13 microfinance practitioners from 9 different organizations participated in a 10-day long training of trainer (TOT) organized by Training Institute for Technical Instruction more...

With the aim of spreading entrepreneurship in the community by making the poor and underprivileged self-reliant and entrepreneurs through microfinance finance institution (MFIs) and more...

The global marketplace is rapidly shifting towards digitalization to enhance consumer access, need & satisfaction. There is vast untapped marketplace for Micro entrepreneurs members from more...

Symposium on Strengthening Microfinance in Nepal was organized by the Centre for Self-help Development (CSD) on 27th July, 2024 (Ashad 12, 2081) at Hotel Yellow Pagoda, Kantipath, more...

The Centre for Self-help Development (CSD) held its 33rd Annual General Assembly on December 2, 2023. The meeting urged microfinance institutions to prioritize socio-economic development more...

The Centre for Self-help Development (CSD) celebrated its 33rd anniversary on 12th August, 2024 (Shrawan 28, 2081) amidst a function in Kathmandu.

The program was chaired by the Chairman more...

The rate of bad loans has been increasing in microfinance institutions with the increasing trend of borrowings for non-productive and consumption purpose by the client members. As obvious, more...

The digital proficiency is crucial for business success, a three-day digital literacy program has equipped 39 micro-entrepreneur members of MFIs and Cooperatives with essential skills for more...

The Centre for Self-help Development (CSD) held its 33rd Annual General Assembly on December 2, 2023. The meeting urged microfinance institutions to prioritize socio-economic development more...